Opening Hook

According to the United Nations, the world's population is projected to reach 9.7 billion by 2050, placing unprecedented pressure on global food production. To meet this demand, agricultural productivity must increase by 70% over the next three decades. Traditional farming methods are no longer sufficient, and the agricultural industry is turning to artificial intelligence (AI) to optimize crop yields and reduce operational costs. This article explores how AI is revolutionizing precision agriculture, providing real-world case studies and a detailed analysis of the business impact and future trends.

Industry Context and Market Dynamics

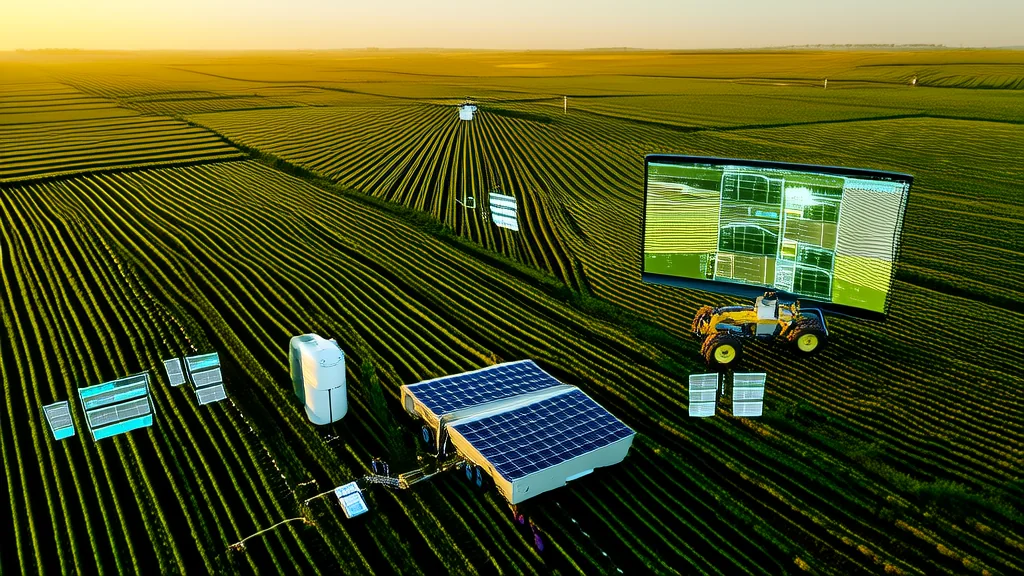

The global precision agriculture market was valued at approximately $6.8 billion in 2021 and is expected to grow at a compound annual growth rate (CAGR) of 12.8% from 2022 to 2030. The increasing need for sustainable and efficient farming practices, coupled with advancements in AI and IoT technologies, is driving this growth. Key pain points in the agricultural sector include labor shortages, climate variability, and the need for precise resource management. AI addresses these challenges by providing data-driven insights, automating tasks, and optimizing decision-making processes.

The competitive landscape in the AI-driven precision agriculture market includes both established tech giants and innovative startups. Companies like John Deere, IBM, and Microsoft are leveraging their technological expertise to offer comprehensive solutions, while startups such as FarmWise and Blue River Technology are focusing on specialized applications. The market is highly dynamic, with continuous innovation and strategic partnerships shaping the industry's future.

In-Depth Case Studies

Case Study 1: John Deere and the See & Spray System

John Deere, a leading manufacturer of agricultural equipment, has developed the See & Spray system, which uses AI to identify and target weeds in real-time. The system employs computer vision and machine learning algorithms to differentiate between crops and weeds, applying herbicides only where needed. This targeted approach reduces herbicide usage by up to 90%, significantly lowering input costs and environmental impact.

Implementation began in 2019, and the system was deployed across various farms in the United States. By 2022, John Deere reported that farms using the See & Spray system saw a 35% reduction in herbicide costs and a 20% increase in crop yield. The system's success has led to its adoption by over 500 farms, with plans to expand globally in the coming years.

Case Study 2: Blue River Technology and the See & Spray Select

Blue River Technology, acquired by John Deere in 2017, has developed the See & Spray Select, a precision spraying technology that uses AI to detect and spray individual plants. The system utilizes high-resolution cameras and deep learning algorithms to identify and classify plants, allowing for precise application of chemicals. This technology not only reduces chemical usage but also improves the overall health of the crops.

The See & Spray Select was piloted in 2020 and commercially launched in 2021. Early adopters, including large-scale cotton and soybean farmers, reported a 50% reduction in herbicide use and a 15% increase in crop yield. The system's implementation timeline was approximately six months, with training and support provided by Blue River Technology. The company projects that the See & Spray Select will be adopted by over 1,000 farms by 2025.

Case Study 3: FarmWise and the Autonomous Weeding Robot

FarmWise, a San Francisco-based startup, has developed an autonomous weeding robot that uses AI to identify and remove weeds without damaging crops. The robot is equipped with multiple cameras and sensors, and it uses machine learning algorithms to navigate fields and perform weeding tasks. This solution eliminates the need for manual labor and reduces the reliance on herbicides.

The autonomous weeding robot was first deployed in 2020 in California and has since been tested in various other states. Farms using the FarmWise robot have reported a 40% reduction in labor costs and a 25% increase in crop yield. The robot can cover up to 10 acres per day, making it a cost-effective solution for large-scale operations. FarmWise plans to scale its operations and deploy the robots in more regions, with a goal of reaching 1,000 units by 2025.

Technical Implementation Insights

The key AI technologies used in precision agriculture include computer vision, machine learning, and deep learning. Computer vision algorithms, such as convolutional neural networks (CNNs), are used to analyze images and identify patterns. Machine learning models, such as decision trees and random forests, are employed to make predictions and optimize resource allocation. Deep learning techniques, particularly recurrent neural networks (RNNs) and long short-term memory (LSTM) networks, are used for time-series analysis and predictive modeling.

Implementation challenges include data quality, model accuracy, and integration with existing systems. High-quality, labeled data is essential for training accurate models, and data collection can be a significant challenge. Integration with existing farm management systems and equipment is also crucial for seamless operation. Performance metrics, such as accuracy, precision, and recall, are used to evaluate the effectiveness of AI solutions. Benchmarks, such as the F1 score and area under the ROC curve (AUC-ROC), provide a standardized way to compare different models and approaches.

Business Impact and ROI Analysis

The quantifiable business benefits of AI in precision agriculture are substantial. For example, John Deere's See & Spray system has reduced herbicide costs by 35% and increased crop yields by 20%. Blue River Technology's See & Spray Select has achieved a 50% reduction in herbicide use and a 15% increase in crop yield. FarmWise's autonomous weeding robot has reduced labor costs by 40% and increased crop yields by 25%. These improvements translate into significant cost savings and revenue increases for farmers.

Return on investment (ROI) is a critical metric for evaluating the financial viability of AI solutions. For instance, a farm that invests in the See & Spray system can expect a payback period of 2-3 years, with ongoing savings and increased yields providing a strong return. Market adoption trends indicate that the demand for AI-driven precision agriculture solutions is growing, driven by the need for sustainable and efficient farming practices. Companies that adopt these technologies gain a competitive advantage by reducing costs, improving yields, and enhancing their environmental sustainability.

Challenges and Limitations

Despite the numerous benefits, there are several challenges and limitations associated with implementing AI in precision agriculture. Technical challenges include the need for high-quality, labeled data and the complexity of integrating AI solutions with existing systems. Data privacy and security are also concerns, as sensitive information about farm operations and crop yields must be protected. Regulatory and ethical considerations, such as the use of chemicals and the potential impact on local ecosystems, must also be addressed.

Industry-specific obstacles include the variability of farming conditions, such as weather and soil types, which can affect the performance of AI models. Additionally, the high initial investment required for AI solutions can be a barrier for small and medium-sized farms. Addressing these challenges requires a collaborative effort between technology providers, farmers, and regulatory bodies to ensure the successful and sustainable adoption of AI in agriculture.

Future Outlook and Trends

Emerging trends in AI-driven precision agriculture include the use of drones and satellite imagery for real-time monitoring, the integration of blockchain for secure data management, and the development of more advanced machine learning models. Predictions for the next 2-3 years suggest that the market for AI in agriculture will continue to grow, with an increasing number of farms adopting these technologies. Potential new applications include the use of AI for pest and disease detection, crop forecasting, and supply chain optimization.

Investment in AI-driven precision agriculture is expected to increase, with venture capital and private equity firms showing growing interest in the sector. Market growth projections indicate that the global precision agriculture market will reach $15.5 billion by 2027, driven by the need for sustainable and efficient farming practices. As the technology continues to evolve, the potential for AI to transform the agricultural industry is vast, offering significant opportunities for both established players and innovative startups.